In Delaware, non-resident companies often find it challenging to navigate the complex world of accounting and tax regulations.

Delaware accounting firms assist foreign companies and individuals in managing their financial matters while conducting business in the state. These firms are crucial for ensuring compliance with Delaware's tax laws and regulations. They provide support in obtaining necessary tax identification numbers and submitting annual reports. This assistance is vital for foreign entities to fulfill their financial obligations in Delaware.

This article explores the main aspects of accounting and tax compliance for non-residents in Delaware and lays the foundation of how House of Companies has innovated and simplified Delaware accounting.

It covers key topics such as corporate income tax, bookkeeping regulations, and the participation exemption. By understanding these elements, non-resident companies can effectively manage their financial matters and seize opportunities in Delaware's business environment.

Non-resident companies often find it challenging to navigate the complex world of accounting and tax regulations.

Delaware accounting firms assist foreign companies and individuals in managing their financial matters while conducting business in the state. These firms are crucial for ensuring compliance with Delaware's tax laws and regulations. They provide support in obtaining necessary tax identification numbers and submitting annual reports. This assistance is vital for foreign entities to fulfill their financial obligations in Delaware.

This article explores the main aspects of accounting and tax compliance for non-residents in Delaware and lays the foundation of how House of Companies has innovated and simplified Delaware accounting.

It covers key topics such as corporate income tax, bookkeeping regulations, and the participation exemption. By understanding these elements, non-resident companies can effectively manage their financial matters and seize opportunities in Delaware's business environment.

To sum up, non-resident companies doing business in Delaware need to navigate Delaware accounting services and tax compliance. This article has examined key areas such as corporate income tax, bookkeeping regulations, and the participation exemption.

It has provided insights into how the Delaware tax system operates and what to consider regarding permanent establishments. When non-resident companies grasp these concepts, they can better manage their financial responsibilities and take advantage of opportunities in Delaware's business environment.

The intricate nature of Delaware's accounting rules underscores the importance of obtaining expert assistance to comply with regulations and avoid potential penalties. When non-resident companies stay informed about their tax obligations and deadlines, they can maintain good standing with Delaware authorities and focus on their core business activities.

To save money with accounting software and request a demo or draft of financial reports, contact House of Companies. Ultimately, non-resident companies need to understand Delaware accounting services and compliance requirements to succeed in the Delaware business scene.

Delaware has a comprehensive legal framework governing financial reporting, primarily based on state-specific regulations and federal guidelines. This framework is supplemented by the Delaware Accounting Standards issued by relevant state authorities, judicial precedents, and applicable federal standards.

Entities with securities listed on regulated markets must comply with additional reporting requirements, including publishing annual financial reports within a specified period after the financial year-end.

The annual financial reporting includes the management board report, audited financial statements, other information, and statements made by the management board attesting to the true and fair view presented by the financial statements and management board report. Entities active in specific industries may also need to publish additional reports on payments to governments within a specified timeframe.

For corporate tax purposes, a Delaware company with substance, i.e., a permanent establishment (PE), is subject to corporate income tax (CIT) on its worldwide income. In contrast, a non-resident company without a PE in Delaware is only liable for CIT on Delaware-source income, such as profits from a PE or income from Delaware real estate.

The term 'permanent establishment' is defined in Delaware's CIT law and follows the definition in applicable tax treaties. For non-treaty situations, the definition aligns with federal guidelines.

Regarding sales tax, a Delaware company with substance must register for sales tax and charge it on its supplies of goods and services. A non-resident company without a PE in Delaware may still be required to register for sales tax if it makes taxable supplies in the state, such as distance sales or e-services to non-sales tax registered customers.

In summary, the presence of a permanent establishment is a crucial factor in determining the corporate tax and sales tax obligations of a company operating in Delaware.

Non-resident entities seeking to establish a presence in Delaware have several legal entity options to choose from, each with its own set of accounting and tax implications. The most common types include branch offices, subsidiaries, and foreign legal structures.

A branch office, also known as a permanent establishment (PE), is not a separate legal entity but an extension of the foreign company. It must be registered with the Delaware Division of Corporations and is subject to corporate income tax and sales tax on profits attributable to the branch.

The branch office is not required to file separate financial statements with the Division of Corporations, but the parent company's financial statements must be submitted.

Subsidiaries, on the other hand, are independent legal entities incorporated under Delaware law. They must register with the Division of Corporations, file annual financial statements, and comply with all Delaware tax obligations, including corporate income tax, sales tax, and payroll tax. Subsidiaries offer greater administrative simplicity and independence compared to branch offices.

Foreign companies can also opt to use their own country's legal structure when setting up a business in Delaware. Delaware company law recognizes all foreign business structures except sole proprietorships. However, using a foreign legal structure may have certain disadvantages, such as increased complexity in dealing with multiple tax authorities.

Registering a branch office in Delaware entails several accounting obligations. The branch must maintain proper books and records, and the foreign company's financial statements must be filed with the Division of Corporations. If the branch has employees, it must set up a Delaware payroll and withhold payroll tax and social security contributions.

The branch office's profits are subject to Delaware corporate income tax, and it must file quarterly sales tax returns. Transfer pricing rules apply to transactions between the branch and its foreign head office, necessitating proper documentation to substantiate the allocation of profits.

The decision between establishing a branch office, subsidiary, or using a foreign legal structure depends on various factors, including the nature and extent of activities in Delaware, tax considerations, and administrative simplicity.

Non-resident entities should consult with legal and tax advisors to determine the most suitable option for their specific situation. House of Companies can assist with this in the shape of a corporate plan, for a fixed fee of $295.

Non-resident entities operating in Delaware must comply with various tax registration requirements to ensure adherence to state regulations. These obligations include registering for sales tax, payroll taxes, and corporate income tax, depending on the nature and extent of their business activities in the state.

Businesses engaged in taxable transactions in Delaware are required to register for a Delaware sales tax number. This applies to both resident and non-resident companies supplying goods or services within the state.

The registration process involves submitting an application to the Delaware Division of Revenue, providing necessary documentation such as proof of business incorporation and identification documents, and appointing a fiscal representative for non-resident businesses.

Once registered, companies must charge sales tax on their supplies, file periodic sales tax returns, and maintain proper records of their transactions. Delaware does not impose a state sales tax, but businesses should be aware of local taxes that may apply. Non-compliance with sales tax obligations can result in penalties and legal consequences.

Businesses employing staff in Delaware are obligated to register as an employer with the Delaware Division of Revenue and deduct payroll taxes from their employees' wages.

Payroll taxes include wage tax, social security contributions, and unemployment insurance premiums.

Employers must file payroll tax returns and remit the withheld amounts to the tax authorities.

Before employing staff, companies must register as an employer and obtain a payroll tax number. They are also required to verify their employees' identities and eligibility to work in the United States. Failure to comply with payroll tax obligations can lead to penalties and legal repercussions.

Resident companies in Delaware are subject to corporate income tax on their worldwide income.

The standard corporate income tax rate varies, and companies must file annual corporate income tax returns and make advance payments throughout the year.

Non-resident companies are liable for corporate income tax only on their Delaware-source income, such as profits attributable to a permanent establishment in the state. They are required to file corporate income tax returns and pay taxes on their taxable income.

An important question to ask yourself is: Is my company considered resident in Delaware? In principle, all companies incorporated under Delaware law are considered 'resident,' unless there is a tax treaty in place, and/or the substance requirements are not met.

This means that in theory, you can run a Delaware business and not report your profits here, but in the country where the company performs its effective management and control. More on this topic can be found in our blog!

Non-resident entities operating in Delaware are subject to various bookkeeping and financial reporting obligations under state law. These requirements are primarily governed by the Delaware General Corporation Law and applicable accounting principles.

Almost every Delaware corporate entity is required to prepare financial statements according to the law, usually incorporated in the entity's statutes.

The financial statements serve as an essential building block for the Delaware legal system and form the basis for corporate governance. They are also relevant for taxation, as they serve as the starting point for determining the taxable basis, although tax laws have independent rules.

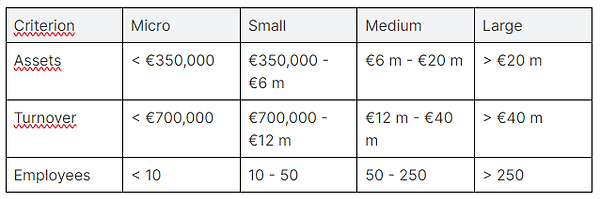

Depending on the company's size and publication requirements, the financial statements generally must contain at least:

The financial statements should accurately reflect the company's financial position, and the accounting principles used must be set out in the financial statements. These principles, once implemented, may only be changed if there are good reasons for such a change, and the reasons and effect on the company's financial position must be disclosed in the notes.

Parent companies in Delaware should generally include the financial data of "controlled subsidiaries" and other "group companies" in their consolidated financial statements.

A "controlled subsidiary" is a legal entity in which the company can directly or indirectly exercise more than 50% of the voting rights at the shareholders' meeting or is authorized to appoint or dismiss more than half of the managing and supervisory directors.

Consolidation may be omitted under certain conditions, such as when the subsidiary or group company meets the criteria for being described as a small company for Delaware statutory purposes or when the financial information has been included in the parent company's consolidated financial statements prepared per applicable federal guidelines.

Under Delaware law, almost every corporate entity is required to prepare financial statements according to the entity's statutes, which serve as an essential building block for the Delaware legal system and form the basis for corporate governance. The financial statements are also relevant for taxation, as they serve as the starting point for determining the taxable basis, although tax laws have independent rules.

The content of the financial statements depends on the company's size and publication requirements but generally must contain at least a balance sheet, a profit and loss account, and notes to the accounts. The financial statements should accurately reflect the company's financial position, and any changes in accounting principles must be disclosed in the notes.

Parent companies should generally include the financial data of "controlled subsidiaries" and other "group companies" in their consolidated financial statements.

However, consolidation may be omitted under certain conditions, such as when the subsidiary or group company meets the criteria for being described as a small company for Delaware statutory purposes or when the financial information has been included in the parent company's consolidated financial statements prepared per applicable federal guidelines.

Foreign businesses operating in Delaware must comply with state sales tax regulations. The Delaware Division of Revenue governs the sales tax obligations for non-resident entities.

Non-resident companies can choose to become resident for sales tax purposes by opening a local office or recruiting local staff. Becoming a resident company simplifies sales tax compliance, as it allows for regular sales tax returns and the use of a fiscal representative based in Delaware.

Alternatively, non-resident companies can maintain their non-resident status and manage their sales tax obligations through appropriate channels. However, this may come with additional administrative requirements and the obligation to file periodic sales tax returns.

Non-resident entities operating in Delaware can choose to prepare their financial statements under either Delaware GAAP or International Financial Reporting Standards (IFRS). The choice of reporting framework has significant implications for the recognition, measurement, presentation, and disclosure of financial information.

Delaware GAAP is primarily based on federal guidelines and state-specific regulations. It is supplemented by the Delaware Accounting Standards issued by relevant state authorities and applicable federal standards.

Entities with securities listed on regulated markets must comply with additional reporting requirements, including publishing annual financial reports within a specified period after the financial year-end.

The annual financial reporting comprises the management board report, audited financial statements, other information, and statements made by the management board attesting to the true and fair view presented by the financial statements and management board report.

In contrast, IFRS is a set of international accounting standards that aims to provide a global framework for the preparation and presentation of financial statements. IFRS is developed and issued by the International Accounting Standards Board (IASB) and is widely recognized as a high-quality, globally accepted accounting framework.

The adoption of IFRS can provide several benefits to non-resident entities operating in Delaware, such as:

However, the transition from Delaware GAAP to IFRS can be a complex and time-consuming process, requiring significant resources and expertise.

Non-resident entities should carefully consider the costs and benefits of adopting IFRS and discuss with House of Companies to ensure a smooth transition.

Dividends from Delaware resident corporations are generally subject to federal and state dividend withholding tax (WHT), depending on the applicable tax regulations.

However, dividends may be exempted under certain conditions, subject to anti-abuse rules, if the recipient of the dividends distributed by the Delaware entity is a resident of a state or country with which the United States has concluded a tax treaty that includes a dividend article.

A foreign company with a branch in Delaware is not obliged to prepare its own Delaware financial statements, although a stand-alone balance sheet and profit and loss account may be required for tax purposes. As a branch is not a separate legal entity, there are no withholding tax consequences for transactions between the head office and the branch.

Parent companies should generally include the financial data of "controlled subsidiaries" and other "group companies" in their consolidated financial statements. Under Delaware law, a "controlled subsidiary" is a legal entity in which the company can directly or indirectly exercise more than 50% of the voting rights at the shareholders' meeting or is authorized to appoint or dismiss more than half of the managing and supervisory directors.

Dividend payments received from a subsidiary should be recorded as financial income on the parent company's profit and loss account. The corresponding receivable should be recorded on the balance sheet until the payment is received.

Outgoing dividend payments to shareholders should be recorded as a reduction in retained earnings on the balance sheet, with a corresponding liability recorded until the payment is made.

Failure to comply with the filing requirements can result in penalties under Delaware law. The management board members may be held personally liable for any damages suffered by third parties as a result of non-compliance with the filing requirements.

To ensure compliance with Delaware accounting regulations, non-resident entities should be aware of the annual reporting deadlines and filing requirements, and seek professional advice when necessary.

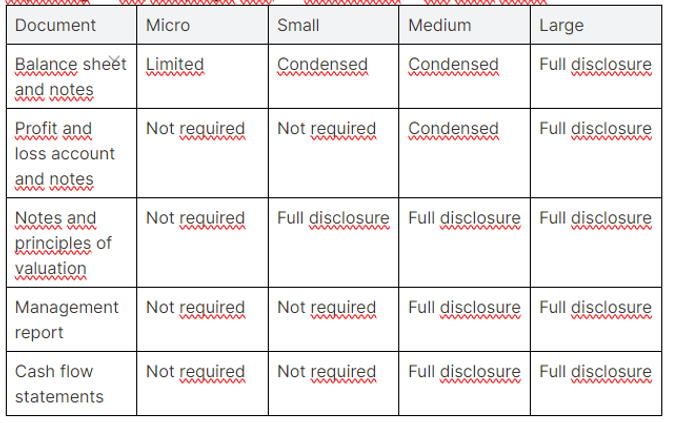

In Delaware, the audit requirements for companies are determined by their size category, similar to the Dutch system. The size criteria are based on three factors: the value of the balance sheet assets, net turnover, and the number of employees. If a company meets at least two out of the three criteria for a specific category in two consecutive years (or the first year for newly formed companies), that category applies.

Under Delaware law, only medium-sized and large companies are legally required to have their financial statements audited by an independent, qualified, and registered auditor.

Micro and small-sized entities are exempt from this requirement, and unaudited financial statements suffice for these smaller companies.

The auditor, appointed by the general shareholders' meeting or, in case of default, by the supervisory or managing board, must provide an auditor's report that includes an assessment of whether the financial statements provide information in accordance with the accounting principles generally accepted in the United States and accurately represent the company's financial position and results for the year.

Non-resident entities operating in Delaware should be aware of these audit thresholds and requirements to ensure compliance with state regulations. Consulting with legal and accounting professionals can help determine the appropriate course of action based on the company's size and specific circumstances.

Feel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!