Ecommerce businesses in Delaware need to comply with the One Stop Shop (OSS) scheme to simplify their VAT obligations across the European Union. With the OSS, sellers can file VAT returns for sales made to EU consumers in a single EU member state, eliminating the need for multiple filings. Our services are designed to assist Delaware-based ecommerce businesses in navigating OSS regulations effectively, ensuring compliance while minimizing administrative burdens.

Our Ecommerce OSS Filing service in Delaware simplifies the VAT compliance process for cross-border sales. We begin by guiding you through the OSS registration process, ensuring that all necessary documentation is accurately submitted to the relevant authorities.

Once registered, we take charge of your VAT reporting obligations by calculating and filing your VAT returns accurately, handling the requirements for multiple EU countries in a single submission.

Our team keeps up to date with the latest regulatory changes to ensure your filings remain compliant at all times. We provide detailed reports and manage all interactions with tax authorities, allowing you to focus on growing your business without worrying about compliance issues.

From initial setup to ongoing management, our expert services ensure seamless and stress-free OSS filing, making VAT compliance straightforward and efficient for your ecommerce operations in Delaware.

Document Extraction and Data Validation From Any Platform

Streamlined Filing Process

Our services simplify the OSS filing process, saving you time and effort.

Comprehensive Data Validation

We ensure that all extracted data is accurate and validated for compliance.

Expert Support Team

Our knowledgeable professionals provide assistance tailored to your ecommerce business needs.

Minimized Risk of Penalties

Timely submissions and accurate filings reduce the risk of costly penalties.

Multi-Platform Compatibility

We can extract data from various ecommerce platforms, ensuring seamless integration.

In addition to ecommerce OSS filing, we offer full-service VAT return submission for Delaware businesses. Our experienced team manages the entire submission process, from collecting necessary documents to filing with the appropriate authorities. This comprehensive approach ensures that you remain compliant with all local and international VAT regulations.

We ensure compliance with local regulations for all business activities.

Our streamlined approach saves you time and reduces administrative burdens.

Our team is always available to answer questions and provide guidance.

The team has been a game-changer for my online store. Their OSS filing services are top-notch, and they handle everything with professionalism and efficiency. I can focus on expanding my business knowing that my VAT compliance is in expert hands.”

Sarah J.,Ecommerce Business Owner

Sarah J.,Ecommerce Business Owner“I highly recommend [Your Company Name] for anyone needing help with OSS filing in the Netherlands. Their knowledge of the regulations is impressive, and their support has made managing my VAT obligations a breeze. Their customer service is exceptional.”

John M., International Retailer

John M., International Retailer“Working with [Your Company Name] has been a fantastic experience. They’ve taken the stress out of VAT compliance for our ecommerce business. Their team is responsive, knowledgeable, and always ready to help with any questions we have.”

Linda K.,Digital Marketing Specialist

Linda K.,Digital Marketing SpecialistFeel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

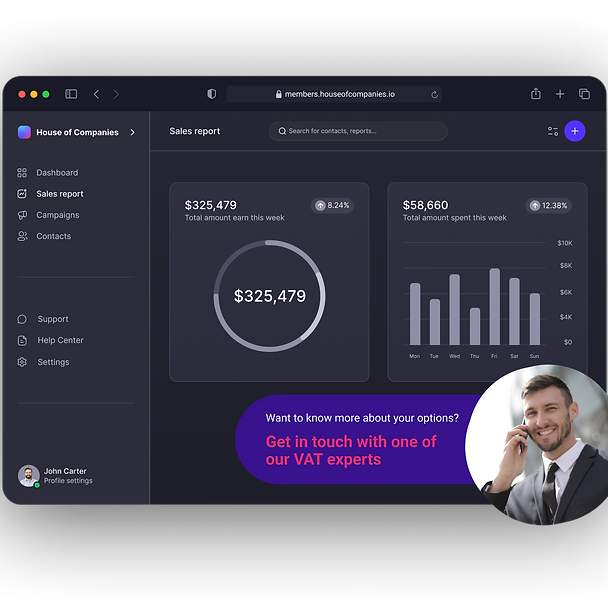

Got questions?

Lets talk about your options

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!