Delaware Annual Reports are mandatory filings required by the Delaware Division of Corporations to maintain your company's good standing in the state. These reports provide updated information about your business and are typically accompanied by franchise tax payments. Timely filing of these reports is crucial for maintaining your company's legal status and avoiding penalties.

The Delaware Division of Corporations, a part of the Delaware Department of State, oversees the filing process and ensures that all businesses registered in Delaware comply with state regulations. At House of Companies, we specialize in helping businesses navigate these requirements efficiently and accurately.

House of Companies simplifies the process of delivering and processing financial documents. Our single-source platform for all documents, data, and reports makes submitting your information easier than ever. Track our progress and your profits in real-time!

House of Companies ensures that your business meets these deadlines, regardless of your entity type. We provide timely reminders and streamlined filing services to keep your Delaware business in compliance.

Despite the expanding nature of tax and accounting resources, your situation may call for the assistance of a Delaware tax professional. House of Companies is here to help with your tax return filing. You can either send us your existing financial records or instruct us to prepare new ones from scratch.

For businesses operating in Delaware, understanding how to prepare financial statements is crucial. It's not just about legal compliance; it's essential for transparency, tracking financial health, and informed decision-making. Financial statements, including the balance sheet and income statement, showcase fiscal responsibility and operational efficiency to stakeholders, potential investors, and regulatory bodies.

This guide provides a structured approach to preparing financial statements according to Delaware regulations and standards. We'll cover gathering financial data, complying with Delaware reporting requirements, understanding legal entities and filing requirements, and the role of tax professionals in Delaware.

Efficiently gathering and compiling financial data is a critical first step in preparing financial statements for a Delaware business. This process ensures accuracy and compliance with Delaware accounting standards, ultimately reflecting your company's financial health.

Delaware businesses are required to maintain accurate financial records, which typically include a balance sheet and income statement. While not all businesses are required to file these statements with the state, they are crucial for tax purposes and may be required by shareholders or potential investors.

Utilizing advanced tools and software can significantly enhance the collection and organization of financial data. House of Companies offers a platform that provides real-time ledger generation and tracking, helping maintain up-to-date financial information. Our tools support the scanning and organized storage of documents, ensuring all financial information is accurately captured and readily available for reporting.

In Delaware, the preparation of financial statements must adhere to specific standards to ensure transparency and compliance. While Delaware doesn't mandate a specific format for private companies, it's advisable to follow generally accepted accounting principles (GAAP).

The balance sheet provides a snapshot of your company's financial position at a given time. It includes assets, liabilities, and shareholders' equity. The balance sheet must adhere to the fundamental accounting equation where total assets equal the sum of liabilities and shareholders' equity.

The income statement, also known as the profit and loss statement, details your company's financial performance over a specific period. It includes revenues, expenses, gains, and losses, providing insights into the company's profitability and operational efficiency.

Our portal facilitates the real-time generation and tracking of financial statements. This platform integrates seamlessly with existing financial systems, allowing Delaware businesses to maintain accurate and up-to-date records. The portal supports the automation of balance sheet and income statement creation, ensuring compliance with Delaware requirements and reducing the risk of misstatements.

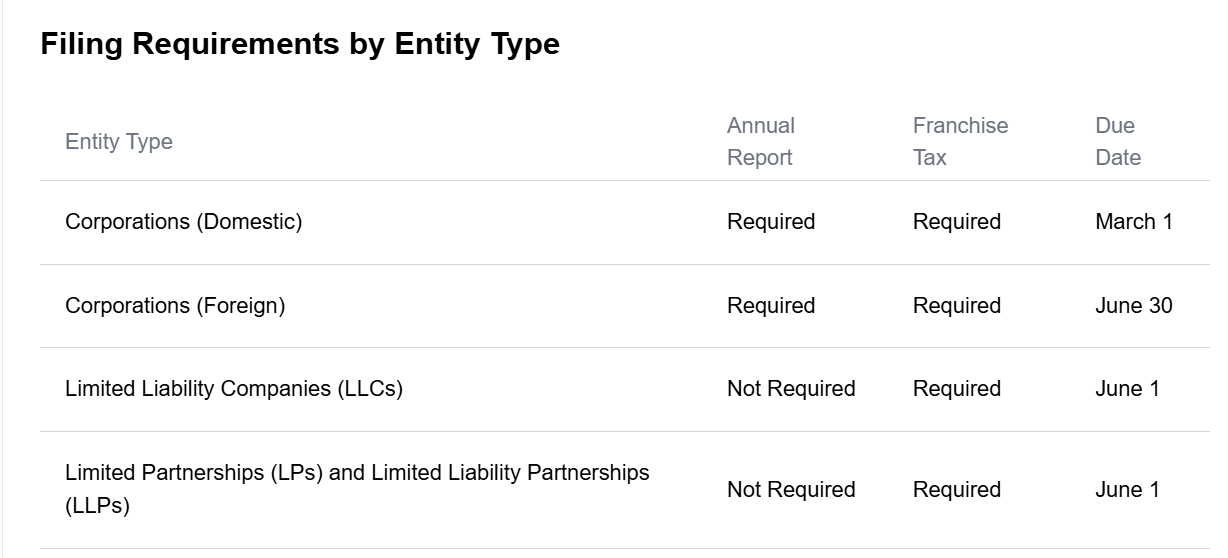

Compliance with Delaware reporting requirements is critical for businesses to maintain legal standing and financial integrity. While Delaware doesn't require most businesses to file financial statements with the state, there are important annual reporting obligations to consider.

Our team at House of Companies is well-versed in the specific requirements set by the Delaware Division of Corporations. We ensure that all necessary information is accurately compiled and reported, minimizing the risk of rejection or delays in processing.

Delaware corporations must pay franchise tax based on either the Authorized Shares Method or the Assumed Par Value Capital Method, whichever results in the lower tax:

The minimum franchise tax for corporations is $175, and the maximum is $200,000 ($250,000 for large corporate filers). House of Companies calculates your franchise tax using both methods to ensure you pay the lowest amount possible while remaining compliant with Delaware law.

For Limited Liability Companies (LLCs), Limited Partnerships (LPs), and Limited Liability Partnerships (LLPs), there is a flat annual tax of $300. Our team ensures timely payment of these taxes to maintain your entity's good standing with the Delaware Division of Corporations.

Delaware is renowned for its business-friendly laws and efficient corporate governance structure. The Delaware General Corporation Law (DGCL) is widely regarded as the most advanced and flexible business formation statute in the nation. Key advantages of incorporating in Delaware include:

House of Companies helps you leverage these advantages while ensuring full compliance with Delaware's regulatory requirements. Our expertise in Delaware corporate law allows us to provide strategic advice tailored to your business needs.

Delaware regularly updates its corporate laws to maintain its status as a leading jurisdiction for business formation. Recent changes that may affect your annual reporting and compliance include:

House of Companies stays abreast of these changes and ensures that your business remains compliant with the latest regulations. We provide timely updates and guidance on how these changes may impact your Delaware entity.

Generally, financial statements of private Delaware companies are not publicly available. However, annual reports filed with the state, which include basic information about the company, are public records.

While Delaware law doesn't mandate specific accounting standards for private companies, many follow Generally Accepted Accounting Principles (GAAP). Publicly traded companies must adhere to standards set by the Securities and Exchange Commission (SEC).

Delaware franchise tax calculations can be complex and vary based on your business structure. House of Companies can assist you in accurately calculating your franchise tax obligations.

Try out the Portal of House of Companies to manage your Annual Financial Statement and reporting requirements in Delaware. We offer fixed fees and minimize the need for extensive involvement of tax professionals. Our advanced technology not only enhances accuracy but also frees up valuable resources, allowing your business to focus on core activities that drive growth and profitability.

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!