Delaware's tax landscape can be complex, with specific requirements and deadlines for VAT reporting. However, with the right guidance and support, businesses in the state can navigate these requirements with ease. At House of Companies, we've made it our mission to simplify the VAT reporting process for our clients, allowing them to focus on their core business activities.

As a content manager for House of Companies, I'm thrilled to provide our clients in Delaware with comprehensive support for their VAT reporting and compliance needs. Our team of experts is equipped with the latest tools and technologies, enabling us to deliver innovative solutions that streamline the VAT reporting process and ensure your business remains fully compliant with Delaware's regulations.

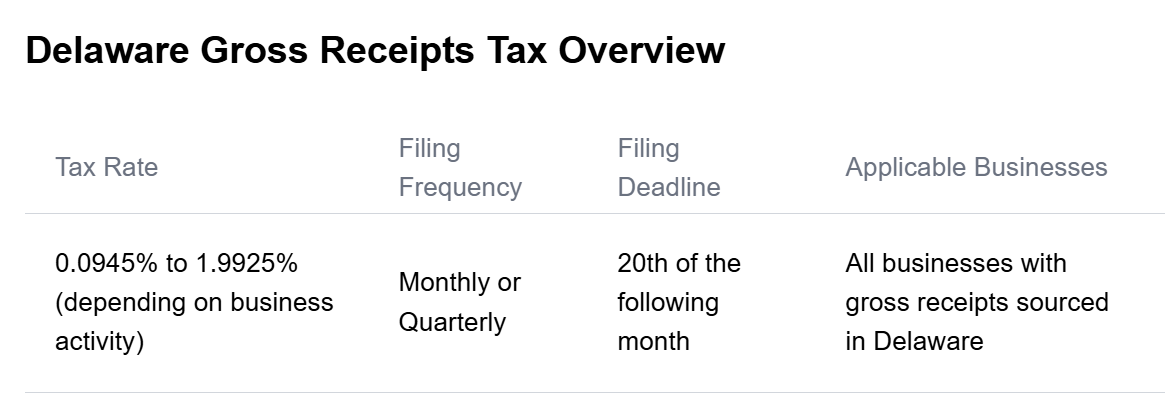

In Delaware, the sales tax is referred to as the Gross Receipts Tax, and it is administered by the Delaware Division of Revenue, a division of the Delaware Department of Finance. Unlike many other states, Delaware does not have a traditional sales tax levied on retail transactions. Instead, the Gross Receipts Tax is imposed on the total revenue of businesses operating in the state.

At House of Companies, we have extensive experience helping businesses comply with Delaware's Gross Receipts Tax reporting requirements. Our team of experts ensures that your company meets all necessary deadlines, files accurate returns, and takes advantage of any available exemptions or deductions.

The Gross Receipts Tax in Delaware is calculated based on the type of business activity. The tax rates range from 0.0945% to 1.9925%, with different rates applying to various industries and business categories.

Our team at House of Companies is well-versed in the nuances of the Gross Receipts Tax calculation and can help you determine the appropriate rate for your business. We ensure that your tax liability is minimized while maintaining full compliance with Delaware regulations.

Failing to comply with Delaware's Gross Receipts Tax requirements can result in:

House of Companies helps you avoid these consequences by ensuring timely and accurate Gross Receipts Tax filings. Our proactive approach to compliance management protects your business interests and maintains your company's legal status in Delaware.

"I expected to take about 2 quarters to generate turnover in Germany. Luckily I didn’t have to spend any money on an accountant in the meantime."

John Smith

John Smith"My Indian accountant drafts my VAT Reports, and submits the return using Entity Management!!"

Deny

Deny"The practical known how is entity managemant made me comfort to get more involve my own tax filling! And it's worked!"

Rose

Rose

Unlike automated chatbots or impersonal call centers, you'll receive personalized support from our team of tax and accounting professionals. They can provide tailored advice and guidance specific to your Delaware business, helping you navigate the complexities of VAT reporting and compliance.

Whether you need assistance with calculating your GRT liability, understanding the latest regulatory changes, or filing your quarterly returns, our experts are here to help. We'll work closely with you to ensure that your VAT reporting is accurate, timely, and in full compliance with Delaware's requirements.

Unlike automated chatbots or impersonal call centers, you'll receive personalized support from our team of tax and accounting professionals. They can provide tailored advice and guidance specific to your Delaware business, helping you navigate the complexities of VAT reporting and compliance.

Whether you need assistance with calculating your GRT liability, understanding the latest regulatory changes, or filing your quarterly returns, our experts are here to help. We'll work closely with you to ensure that your VAT reporting is accurate, timely, and in full compliance with Delaware's requirements.

By partnering with House of Companies, Delaware businesses can streamline their VAT reporting and compliance processes, freeing up valuable resources to focus on core business activities and growth. Our comprehensive services and personalized support ensure that you can maintain a strong financial footing and remain in good standing with the state of Delaware.

All you known about VAT requirement for your new business

Feel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

Got questions?

Lets talk about your options

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!