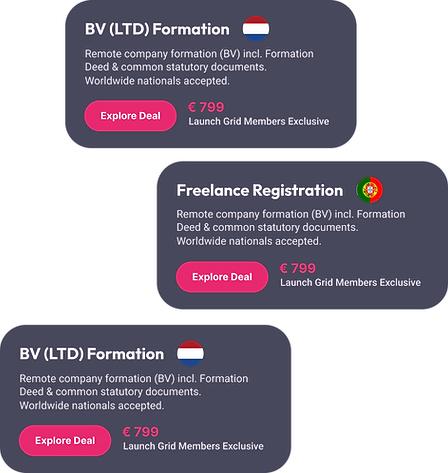

Leverage our expertise in managing Delaware shelf companies through our comprehensive Entity Management Site. Discover how House of Companies ensures a seamless acquisition process while adhering to Delaware's local regulations, offering rapid solutions for establishing a business presence.

Purchasing a shelf company can be almost immediate, as it is already registered and ready for business, bypassing the often time-consuming initial registration process.

A shelf company may come with an established date that suggests longevity, potentially enhancing credibility with banks, investors, and clients.

Starting a new entity can be time-intensive due to the steps involved, including name registration, documentation preparation, and submission to regulatory authorities.

Newly formed entities start without any history, which may affect perceptions of reliability and make it more challenging to build trust with stakeholders.

The upfront cost of purchasing a shelf company is generally higher, factoring in its perceived value due to established age, although it may offer fewer initial setup costs.

Forming a new entity usually involves fewer initial costs, though additional expenses may arise for documentation, compliance, and administrative requirements.

Shelf companies might come with established compliance histories; however, they may not align with current business operations, requiring updates to maintain compliance with present regulations.

A new entity offers a fresh start for compliance, allowing the business to establish and maintain records that align perfectly with its operations and meet current regulatory requirements.

Shelf companies may carry risks if prior compliance and tax records were not properly maintained, which could lead to potential liabilities.

A newly formed entity minimizes potential past risks or liabilities, as there is no history of business activities, ensuring a clean slate for business operations.

For those looking to bypass the complexities of forming a new legal entity, a shelf company can be an attractive alternative.

Shelf companies are pre-existing entities that have been established but remain inactive, with no previous business activity. Purchasing a shelf company provides a quick, ready-to-use legal entity with an existing corporate history, which can improve credibility with clients and lenders. This can expedite processes like loan applications or contract negotiations.

However, it's essential to review a shelf company's history thoroughly, as unexpected liabilities may arise. This alternative can save time, but careful vetting is crucial.

"I was impressed with how fast and easy it was to acquire a shelf company. The process was seamless, and I was able to start operating my business immediately!"

John M.

John M."Their professional support made the entire transfer process smooth. I now own a ready-to-use company with no hassle at all. Highly recommend!"

Sarah L.

Sarah L."The shelf company I purchased came with a solid reputation, which helped boost my business credibility right away. Excellent service and communication throughout the process!"

David K.

David K.

Understanding the Benefits of Launching a Business in Delaware

Launching a business in Delaware offers strategic advantages for entrepreneurs. Known for its favorable corporate laws and business-friendly environment, Delaware provides a strong legal framework for businesses to thrive, with benefits like tax incentives, asset protection, and streamlined legal procedures that attract entrepreneurs worldwide.

Navigating Delaware’s Legal and Regulatory Frameworks

Launching a business in Delaware requires an understanding of its unique legal and regulatory frameworks. Delaware's Division of Corporations oversees company registration, tax regulations, and compliance requirements. To ensure your business meets state regulations, working with Delaware-based legal experts can simplify the process and help avoid legal issues.

Building a Global Network from Delaware

Delaware is home to a large and diverse network of legal, financial, and professional services. Establishing connections with local partners, investors, and customers offers critical market insights and business opportunities, positioning your Delaware-based enterprise for global growth.

Delaware offers flexible business structures, including Corporations, Limited Liability Companies (LLCs), and Limited Partnerships (LPs). Each structure has distinct legal and tax implications. Deciding on the best entity type is essential to ensure asset protection, tax efficiency, and scalability.

Incorporating in Delaware involves specific steps, including selecting a unique business name and filing a Certificate of Incorporation with the Delaware Division of Corporations. This process includes paying a filing fee, and it's essential to verify the availability of the business name with the state.

Delaware businesses must comply with annual requirements, including the franchise tax payment and an annual report. Depending on the industry, additional licenses or permits may be required to operate legally in the state. Following these regulations is essential to maintain compliance and avoid penalties.

Professional services can manage essential Delaware registration documents, including the Certificate of Incorporation and shareholder agreements. This ensures all paperwork is accurately completed and adheres to Delaware's legal standards, minimizing delays.

Professional services provide expertise on Delaware’s specific requirements, helping clients understand compliance obligations. Their familiarity with Delaware’s regulations helps avoid costly mistakes and ensures a smooth registration process.

Professional services can expedite registration through established connections with Delaware’s Division of Corporations, allowing for faster processing. This enables business owners to focus on growth while professionals handle regulatory matters.

Choosing the Type of Entity Delaware offers flexible structures, including Corporations, LLCs, and LPs. Each type provides different levels of asset protection and tax benefits.

Drafting the Certificate of Incorporation The Certificate of Incorporation outlines the business’s name, purpose, and structure. This must be filed with Delaware’s Division of Corporations.

Filing with Delaware Authorities Filing the Certificate and paying associated fees formalizes your entity, allowing it to operate within Delaware.

Creating Internal Governance Documents Internal documents, such as bylaws or an operating agreement, provide guidelines on business operations and management.

Obtaining Necessary Licenses and Permits Delaware businesses may need industry-specific permits, essential for compliance and operational legality.

Ongoing Compliance Obligations Delaware entities must file an annual report and pay franchise taxes. Staying compliant ensures good standing with the state.

Delaware offers a favorable environment for both domestic and international enterprises. Researching local and international market trends is essential to identify opportunities.

Establishing a solid Delaware-based business model is crucial. This includes pricing strategies, service offerings, and a capable management team.

As markets change, Delaware-based businesses must remain adaptable. Monitoring industry trends allows companies to stay relevant and competitive.

Engaging professionals such as accountants, attorneys, and consultants provides expertise in Delaware’s regulatory and operational landscape. Their assistance ensures legal compliance and optimized financial strategies, which are crucial for sustainable growth.

This Delaware-focused content structure is designed for SEO with relevant keywords, and provides comprehensive guidance for entrepreneurs interested in forming or managing a business entity in Delaware.

Purchasing a shelf company can save time, establish instant credibility with clients and investors, and allow for immediate business operations. It can also provide the perception of longevity, which may be advantageous in certain industries.

The drawbacks of shelf companies include potentially higher costs, the need for due diligence to ensure there are no hidden liabilities, and the necessity to update compliance records to align with current regulations and business activities.

Forming a new legal entity typically takes several days to weeks, depending on the jurisdiction and the complexity of the business structure. This includes steps like name registration, documentation preparation, and regulatory approvals.

While new legal entity formation usually has lower initial costs, purchasing a shelf company can sometimes be more economical in the long run if the immediate establishment of credibility and business operations is critical to the business strategy.

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!